11 Top Banking Technology Trends to Watch in 2025

Welcome to 2025 – or at least, the threshold of it. The banking sector, once perceived as a bastion of tradition, has undergone a seismic shift. Being technologically advanced isn’t just a nice-to-have anymore; it’s the absolute bedrock of survival and success. The industry isn’t merely ‘going digital’; it’s transforming into a fully-fledged, tech-powered ecosystem.

This evolution brings immense opportunity, but also relentless pressure. Banks face a constant need to innovate, outpace competitors, meet rapidly changing customer expectations, fend off sophisticated cybersecurity threats, and drive operational efficiency. The core challenge is clear:

The answer lies in vigilance and adaptation – staying acutely aware of and strategically embracing the latest banking technology trends. We’re moving beyond incremental updates to foundational changes, from biometric authentication potentially making passwords obsolete to blockchain enabling near-instant, secure transactions.

But knowing the trends is only half the battle. The real question is how to effectively integrate these advancements into your organization’s DNA. This blog post explores 11 pivotal banking technology trends shaping the landscape in 2025, offering insights into how they are revolutionizing the industry.

Top Banking Technology Trends to Watch in 2025

-

-

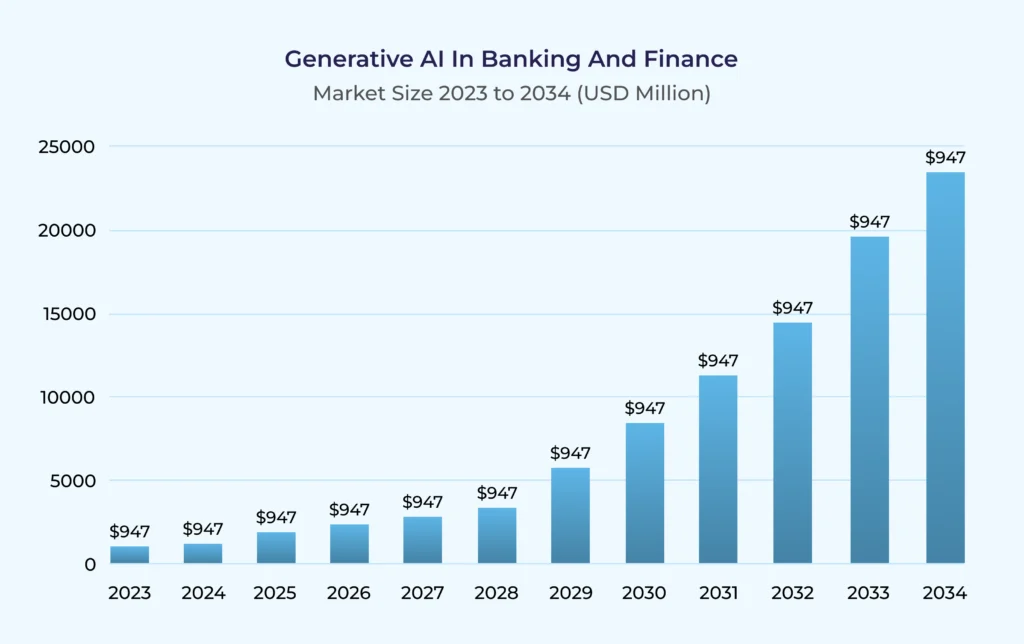

Generative AI: Revolutionizing Customer Service & Operations

No modern bank can afford to ignore Generative AI. Its impact is profound and multifaceted. While sophisticated chatbots providing instant, human-like customer support are the most visible application, GenAI’s influence runs much deeper. It’s being used to generate realistic synthetic data for robust fraud detection model training, identify anomalies in transaction patterns, personalize financial advice at scale, and automate complex back-office tasks like risk assessments, loan processing, and compliance checks. As market forecasts suggest exponential growth (reaching potentially over $21 Billion by 2034), AI is undeniably becoming central to banking efficiency and intelligence.

- Key Impacts: Dramatically improved customer service, enhanced fraud detection and risk management, significant cost savings through automation.

-

Blockchain: The Backbone for Secure & Transparent Transactions

Beyond its association with cryptocurrencies, blockchain technology offers fundamental improvements for core banking functions. Its immutable and decentralized ledger makes transactions incredibly secure and transparent, drastically reducing opportunities for fraud. Every transaction is recorded, validated, and tamper-proof. This fosters trust and allows banks to identify anomalies in real-time. Furthermore, blockchain streamlines processes like Know Your Customer (KYC). Banks can securely share validated customer identity data on a shared ledger, eliminating the need for customers to repeat the tedious KYC process with multiple institutions.

- Key Impacts: Unparalleled security and fraud prevention, increased transparency and trust, faster and cheaper cross-border payments, streamlined KYC processes.

-

Biometric Authentication: Raising the Bar for Security & Convenience

Protecting customer funds and sensitive financial data is paramount. Traditional passwords and PINs are increasingly vulnerable. Biometric authentication – using unique biological traits like fingerprints, facial recognition, and voice patterns – provides a far more robust security layer. It’s significantly harder to replicate or steal biometric credentials compared to passwords. Crucially, this enhanced security doesn’t come at the cost of user experience; biometric logins are often faster and more seamless than typing complex passwords, removing friction from customer interactions.

- Key Impacts: Greatly enhanced security against unauthorized access, reduced fraud risk, faster and more convenient customer authentication.

-

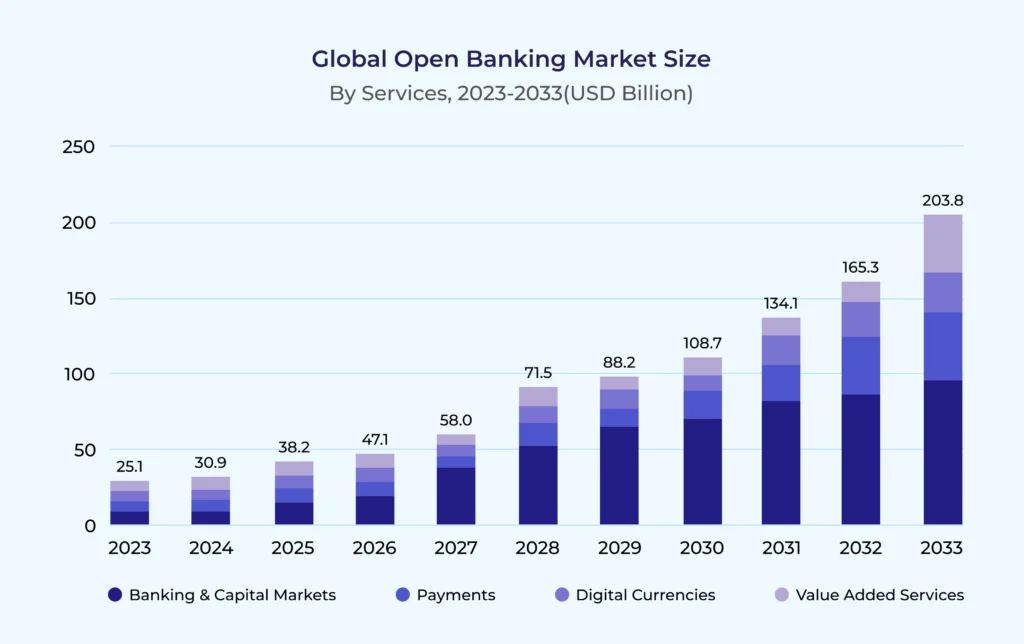

API-Driven Innovation: The Era of Open Banking

Open Banking, facilitated by Application Programming Interfaces (APIs), continues its ascent in 2025. APIs act as secure bridges allowing banks, fintechs, and other third-party providers to share data and functionality (with customer consent). This fosters innovation and empowers customers. They can access aggregated views of their accounts from different institutions, receive highly personalized financial advice from specialized apps, and utilize integrated budgeting tools – often all within a single platform. Open Banking promotes competition and gives customers greater control over their financial lives.

- Key Impacts: Fosters innovation and new service development, empowers customers with better financial control and access, enables seamless integration with fintech ecosystems.

-

Quantum Computing: Powering Advanced Financial Modeling

While still maturing, quantum computing holds transformative potential for complex financial calculations that are currently intractable for classical computers. Its ability to process vast numbers of variables simultaneously can revolutionize areas like portfolio optimization, risk management, and derivative pricing. Quantum algorithms could analyze billions of data points to identify optimal investment strategies or create high-dimensional risk models in seconds, tasks that might take traditional computers days. Banks investing early in understanding and experimenting with quantum capabilities will gain a significant analytical edge.

- Key Impacts: Breakthroughs in complex financial modeling, highly sophisticated risk analysis, optimized investment strategies, potential for enhanced cryptographic security (and new challenges).

-

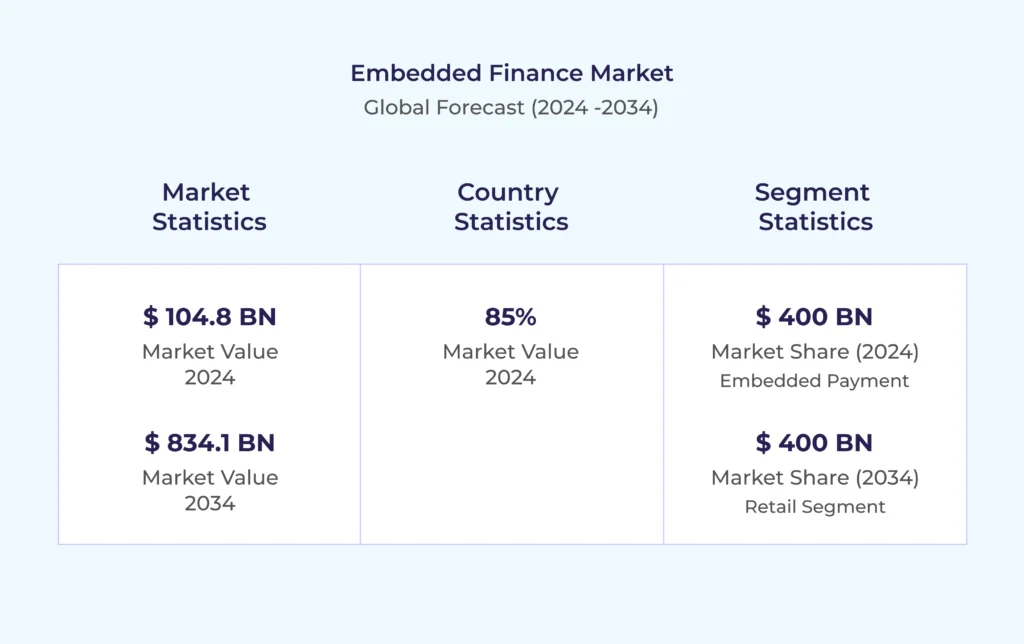

Embedded Finance: Banking Where the Customer Is (BaaS)

Banking services are increasingly integrated directly into non-financial platforms, thanks to Banking-as-a-Service (BaaS) models. Think “buy now, pay later” options at eCommerce checkouts, instant insurance offers when booking travel, or seamless payment processing within business software. Embedded finance makes financial services accessible and convenient, meeting customers in their daily digital journeys. For banks, it opens new distribution channels and revenue streams by partnering with retailers, tech companies, and other businesses.

- Key Impacts: Increased accessibility of financial services, new revenue streams for banks and non-banks, more seamless customer experiences integrated into everyday platforms.

-

Hyper-Personalization: Beyond Knowing Your Customer

Moving far beyond basic segmentation, hyper-personalization uses AI and vast datasets (purchase history, app usage, support interactions, even social media cues with consent) to understand individual customer needs, behaviours, and potential future actions with remarkable granularity. It’s about anticipating needs proactively. For instance, identifying a frequent international traveler and offering tailored travel insurance or a high-value international credit card before they even start planning their next trip. This deep understanding drives customer loyalty and satisfaction.

- Key Impacts: Highly relevant and timely product/service offerings, increased customer engagement and loyalty, improved predictive insights for financial planning.

-

IoT for Real-Time Monitoring & Smart Banking

The Internet of Things (IoT) extends its reach into banking infrastructure. Sensors deployed in branches and ATMs enable real-time monitoring for security (detecting tampering or suspicious activity), predictive maintenance (identifying potential ATM failures), and optimizing physical operations (monitoring foot traffic). Connected devices can provide valuable data for risk assessment (e.g., monitoring collateral) and enhance the overall efficiency and security of physical banking assets.

- Key Impacts: Enhanced physical security and fraud prevention (e.g., smart ATMs), optimized branch and ATM operations, potential for new data streams for risk assessment.

-

RegTech: Automating Compliance in a Complex World

Regulatory Technology (RegTech) leverages AI, machine learning, and data analytics to help financial institutions navigate the ever-growing web of regulatory requirements more efficiently and effectively. AI-powered tools can monitor transactions in real-time to detect potential money laundering or fraudulent activities, automate the generation of compliance reports, and ensure adherence to complex rules, reducing the risk of costly penalties and manual effort.

- Key Impacts: Reduced compliance costs and burden, improved accuracy and speed of regulatory reporting, enhanced detection of financial crime, lower operational risk.

-

Central Bank Digital Currencies (CBDCs): The Evolving Landscape of Money

While still in various stages of exploration and pilot programs globally, CBDCs are a significant trend to watch. These government-backed digital currencies could potentially streamline payment systems, reduce transaction costs (especially cross-border), improve financial inclusion, and provide central banks with new tools for implementing monetary policy. Banks need to monitor CBDC developments closely and prepare for their potential integration into the financial ecosystem.

- Key Impacts: Potential for more efficient domestic and cross-border payments, reduced reliance on physical cash, new avenues for monetary policy implementation.

-

Robo-Advisors: Democratizing Investment Advice

AI-driven robo-advisors continue to gain traction, offering automated, algorithm-based investment advice and portfolio management. By analyzing market data and individual customer risk profiles, they provide personalized investment strategies at a lower cost than traditional human advisors. This makes sophisticated wealth management accessible to a broader audience, helping customers with financial planning and optimizing their investment portfolios based on data-driven insights.

- Key Impacts: Increased accessibility of investment advice, lower costs for wealth management, personalized and automated portfolio management.

-

Embracing the Future of Banking

Embracing the Future of Banking

The technological transformation of banking is not slowing down. These 11 trends represent a fundamental shift in how financial services are delivered, managed, and secured. From AI optimizing every interaction to blockchain fortifying transactions, the future demands agility, strategic investment, and a willingness to embrace change.